This article looks at current and historical IRD debt collection and what IRD is and isn’t doing about it.

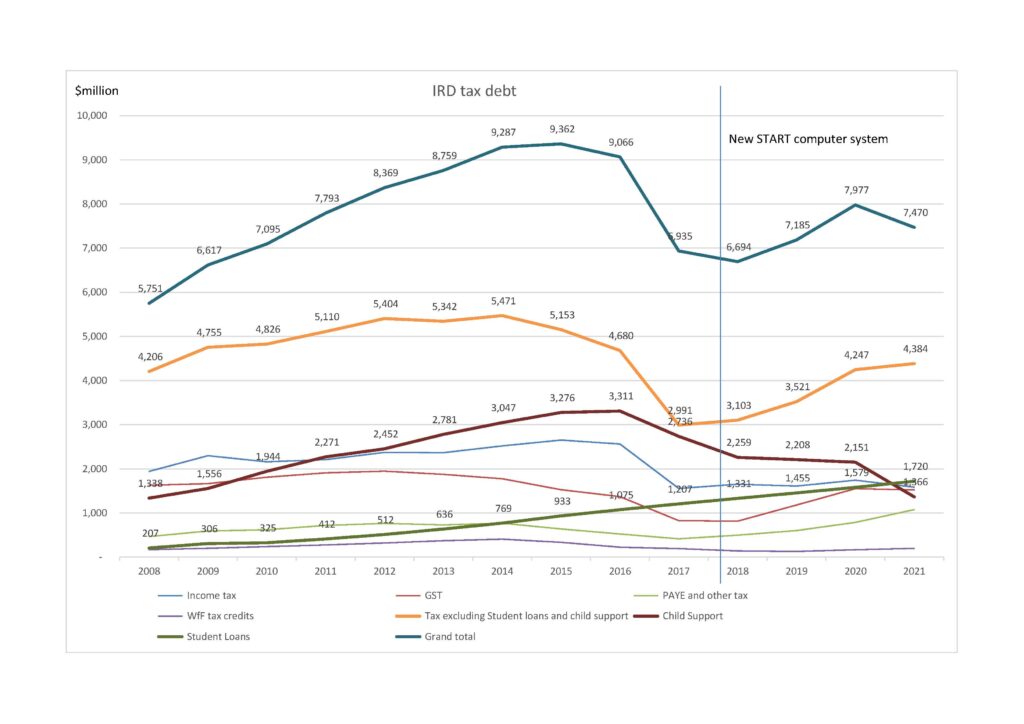

To whet your appetite look at the chart below:

In this article we comment on collection performance pre and post the new START computer system, and how we think IRD is getting it wrong.

Debt collection 2008 to 2017

In 2017 or thereabouts IRD published some interesting statistics in respect of its debt collection performance. That material is available from an IRD archive page at www.ird.govt.nz/about-us/archived-statistics/debt/overdue-debt-tax-type. However the analysis is a bit peculiar and we make our own comments here.

From June 2008 to June 2015 overall debt increased from $5.7 billion to $9.4 billion before dropping rapidly to $6.9 billion in 2017.

However if we split out student loans and child support the performance is somewhat different.

Excluding those two tax types, tax debt started at $4.2 billion, gradually increased to $5.5 billion and then dropped back to $3 billion

In the meantime child support increased by over 100% and student loans by a staggering 480% albeit on smaller numbers.

We note that IRD ‘s statistics don’t distinguish between core debt and interest /penalties which for some tax types causes the debt to rapidly increase from a small hill to an unassailable mountain.

By February 2018 the IRD collections team employed around 750 staff and had the ‘highest employee engagement’ across all divisions of Inland Revenue– whatever that means.

www.customerexperience.com.au/post/where-are-they-now-with-nz-inland-revenue

External stakeholders may have held a different view.

2018 IRD restructure

Just as we thought things might be getting better, they got worse (apologies to Jeremy Clarkson).

Since 2018, IRD has undergone its Business Transformation programme significantly reducing staff numbers and rolled out its new tax technology system START. Whether these changes have been a success is complicated by the impact of Covid19 however in respect of debt the stark figures don’t look good.

Overall debt increase

IRD’s Annual Report for 2021 shows that from 2018 to 2021 debt has increased 41% from $3.103bn in 2018 to $4.384bn. (page 39 of the report). That is after writing-off $0.8 billion in the 2021 year (up from $411.6m in 2020).

www.ird.govt.nz/about-us/publications/annual-corporate-reports/annual-report

However underneath that are some more disturbing statistics

Again we have reordered IRD’s numbers and run some more analysis – see the link below

Overdue debt by tax type 2008 to 2021 published

Child support debt

The Child Support Amendment Act 2013 expanded the circumstances where IRD could write off uncollectable child support debt from 1 April 2015.

As a result from 2016 to 2021 that debt has dropped from $3.311 billion in 2016 to $1.366 billion in 2021, largely through the write-off of penalties.

Student loan debt

To our knowledge student loan debt remains collectable forever and has continued to increase year on year. Student loan debt has increased by 42% – from $1.27 billion to $1.72 billion.

All other tax has increased by 46.6% from $2.99 billion to $4.38 billion – this increase partly masked by the somewhat artificial writeoff of child support debt. The biggest contributors here are an 84.5% increase in GST and a staggering 159% increase in PAYE. What’s the bet that a large percentage of that is compounding interest and penalties and IRD will never get to collect it.

Automated correspondence

IRD’s changes are aimed at automating processes, which is fine if there is sufficient human intelligence in the process design stage and sufficient skilled staff available to follow up as required; whether for non-response or to properly consider any replies received.

We have published a companion article on this topic.

The automatic processes often don’t acknowledge work being done by agents attempting to resolve the outstanding debt through discussions with IRD. We have clients where voluntary disclosures have been made in good faith, agreements have been reached on a final amount to pay, funds arranged to make the payment but then goodwill is lost when the ‘system’ automatically issues payment demands, even to the extent of deduction notices to the client’s employer part way through the exercise.

All because, we are told, regardless of the impact on the client and the agent who has to deal with the fallout, it is too difficult to stop notices being sent.

In our experience, like so much coming out of IRD (and many other large organisations) there appears to be excessive focus on sending out hundreds of thousands of automated letters in substitution for human intelligence. After IRD gets no reply to the first 50 letters, no one to step in and say maybe there is a better approach.

We have had businesses referred to us who have accumulated hundreds of thousands of dollars of tax debt and all they have had out of IRD is literally hundreds of letters saying variations on:

You have an overdue amount to pay/this was due on xxx/interest applies/you may also be charged late payment penalties/you may be charged a non payment penalty/you can set up an instalment amount/if you do not pay we may take collection action

The general theme appears to be that if a taxpayer doesn’t put their tax debt right within a few weeks then IRD will take collection action leading to blah blah blah.

But then nothing happens and taxpayers learn to ignore IRD. Any advisor saying enforcement action is a risk faces their own risk of losing credibility with their client.

For one individual taxpayer referred to us, over four years IRD sent over 120 documents in respect of income tax and student loans including a couple of ‘final notices’ three and four years ago respectively. No tax collected.

For a company referred to us, again over four years we count 270 documents in respect of PAYE, GST and income tax. When we offered an arrangement including a substantial lump sum and ongoing payments to clear ALL tax plus IRD interest, instead of grabbing the cash with both hands IRD preferred to follow a script and argue about budgets and source documents, with the ultimate result that part of the settlement disappeared into legal fees and IRD collected less than we had offered. D’uh

Now insolvency experts say that a long-running decline in Inland Revenue debt enforcement action – that slumped further to help mitigate Covid economic fallout – may be helping to prime a coming “tsunami” of business failures – see www.nzherald.co.nz and search for “Inland Revenue Laxity” and “Inland Revenue takes flak over surge in overdue taxes”

Conclusion

A healthy tax system needs the public to pay their tax in the knowledge that IRD will take action against those who do not.

It is debatable whether tasking the IRD to collect Student Loan, and particularly Child Support, enhances the IRD’s reputation with debt collection. The three types of debt seem to have quite different characteristics.

Increasingly the perception is that IRD can’t deal with the issue using automated processes and there are insufficient skilled staff available to appropriately deal with any responses.

Thanks for your thoughts on this Jeff, it’s an interesting and informative read. The goodwill of voluntary compliance will reduce if as you say IR has no stick or is not using on those that they could and not giving some incentives to those who really are trying to clear up their debts.

In a small accountancy group last week we concluded that almost all of the clients that we had with effort and expense to them – helped them get out of tax debt within 5 – 7 years found themselves back in it. So perhaps it’s not just an Inland Revenue problem but a human behaviour problem that many in NZ are too selfish to think of the wider good in the community as a result of paying their fair share of tax.