IRD new computer system and the benefits (and perils) of automation

Are we there yet?

Not a question that anyone wants to hear bringing with it memories of long journeys on roads that twist and turn and with no real understanding of where we are, or maybe even where we are going.

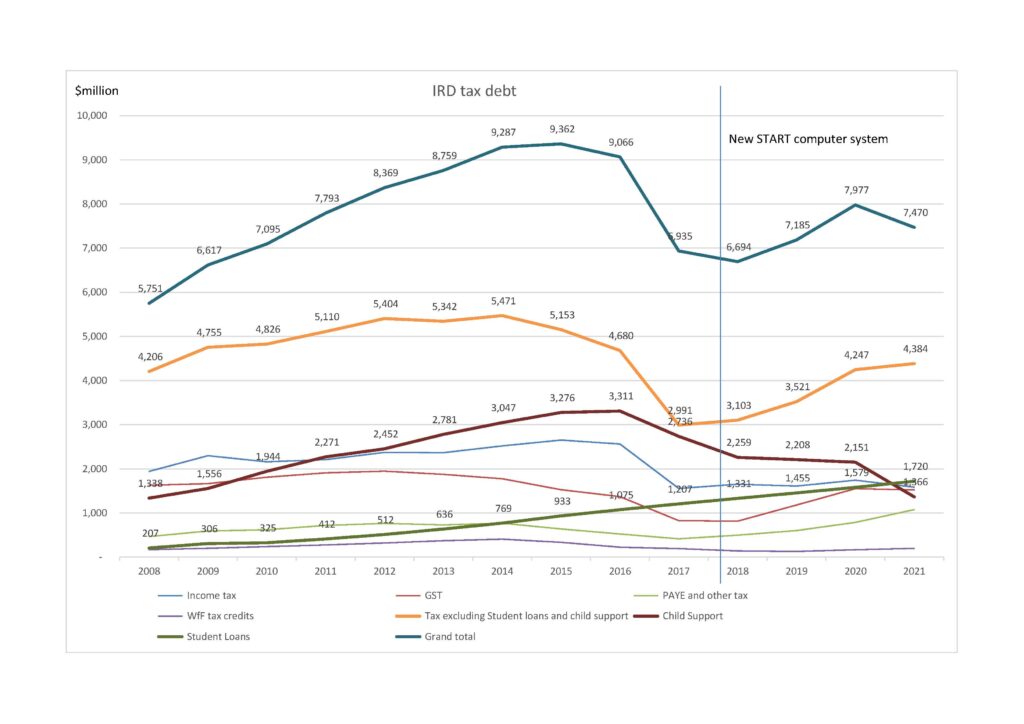

It has now been six months since Inland Revenue proudly announced the successful completion of the last of a three phase journey to deliver the $1.7 billion START system – see

www.ird.govt.nz/media-releases/2021/inland-revenue-systems-re-open

There is no doubt that enhancements were made – the rapid deployment of the Covid19 support products being good examples. There is both good and bad in the new system.

However a significant negative is the deluge of correspondence direct to the taxpayer. This undermines the relationship between the taxpayer and the tax agent, and creates a huge amount of waste to the economy with taxpayers and tax agents having to spend too much time sorting out these unnecessary IRD initiated contacts direct to the taxpayer.

Read on “IRD new computer system and the benefits (and perils) of automation“